Bybit Review 2024: Is Bybit Safe?

Bybit has established itself as one of the leading spot and derivatives exchanges in the cryptocurrency industry and it’s right there in the league of Binance, Coinbase, and other major names. Launched back in 2018, the exchange is serving millions of users from all over the world.

The platform offers a very user-friendly experience, as well as a suite of advanced trading tools, thus catering to both beginner traders and seasoned professionals.

It supports a wide range of trading pairs—virtually all of the popular coins are available to trade on the spot and on its derivatives platform. Bybit has also made a point of listing popular and trending cryptocurrencies quickly, allowing traders to capitalize on upcoming and ongoing trends.

In the following Bybit review and guide, we take a complete overlook of the platform, how to use it to open and close positions, and everything in between.

Bybit Review

PROS

- Great UI/UX, extremely intuitive platform

- Highly responsive support team

- Reliable and highly-secured platform

- Large variety of trading pairs

CONS

- Trading tools geared more toward professionals

How to Trade on Bybit

In this section of our Bybit review, we take a closer look at how to trade on the platform and many of its trading tools.

Bybit provides an all-round cryptocurrency exchange platform. Users can dive into spot trading, options, margin trading, futures trading, and whatnot.

For the sake of this guide, we will stick to perpetual contracts, or, as it’s most commonly referred to in the cryptocurrency industry – futures trading. Before we dive deeper into how to trade on Bybit, let’s provide some clarity on what perpetual futures contracts are. Keep in mind, though, that Bybit also offers spot trading, options trading, and others.

What is a perpetual futures contract?

A perpetual futures contract represents a regular futures contract but it has no expiry date. It’s a derivative product that allows you to open and close positions with leverage whenever you want to, without having to deal with expiry dates.

Large Call to Action Headline

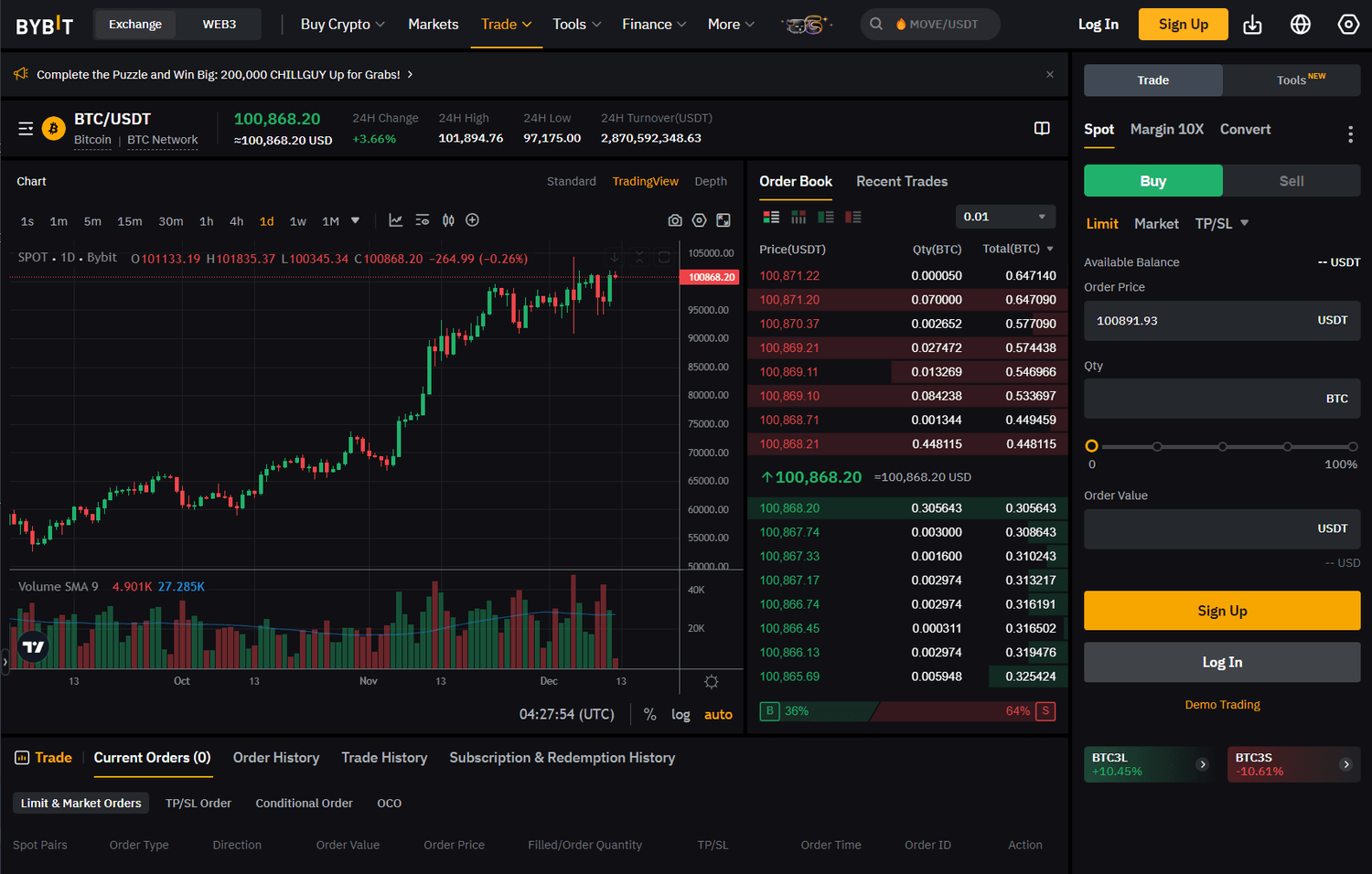

Bybit has evolved into a very precise and efficient trading platform with multiple features that traders can tune to their advantage to optimize their experience. This is what the trading interface looks like:

Central to the entire interface is the trading chart. Right above it, you can find essential information about the trading pair of choice, such as the current price, change during the past 24 hours, the daily highs and lows, as well as the overall trading volume, open interest, and funding rates.

Next to it, you can find the order book, that can be tuned to different depth and views. On the right side, you will find the different trading tools such as the leverage bar, the margin type, order types, and more.

Adjusting Leverage

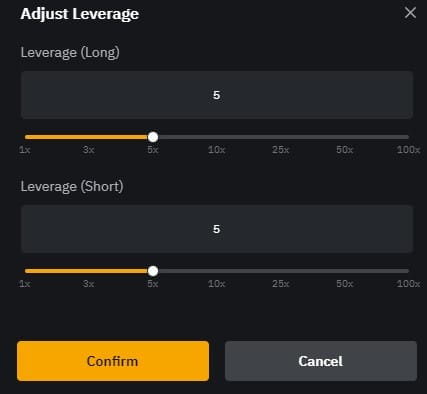

Adjusting your leverage is very easy. As soon as you hit the leverage button, you will find this pop-up:

Here, you can set whatever leverage you want. Bybit supports leverage of up to 100x on select cryptocurrency pairs.

However, trading with high leverage is incredibly risky. It significantly increases the chances of capital losses and it should only be exercised by seasoned veterans and traders with sufficient experience. Anything above 5x can be dangerous, so make sure to exercise with caution.

Adjusting Margin Modes

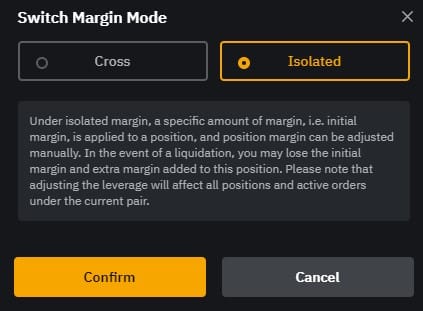

Once you have your leverage set up, you can also choose which type of margin mode you want to use. The button to adjust this is right next to the leverage one:

Bybit supports, like most exchanges, two types of margin modes:

- Isolated margin – it applies a specific amount of margin (i.e. the initial margin_) to a position. You can adjust this manually. However, in the event of a liquidation, you may lose only the applied margin to this specific position.

- Cross margin – all of your available balance of the corresponding account will be deployed to meet the maintenance margin requirements.

Different Order Types

Bybit provides a few different types of orders that cater to beginners and advanced traders.

- Market Order

This is the simplest order type. You select an amount of Bitcoin (for example) that you wish to buy or sell and then hit the Long or Short button, respectively. The order will be executed at the best available price of Bitcoin on the order book.

- Limit Order

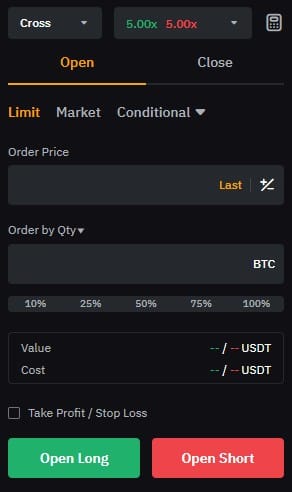

With a limit order, you can set the price at which your order will be executed. For example, if Bitcoin is currently trading around $68,000 but you want to buy once the price declines to $67,000 – all you have to do is specify that in the order as a limit price:

- Limit Order

With a limit order, you can set the price at which your order will be executed. For example, if Bitcoin is currently trading around $68,000 but you want to buy once the price declines to $67,000 – all you have to do is specify that in the order as a limit price:

There are a few other conditional orders, which are mostly designed for advanced traders:

- Chase limit orders

- TWAP

- Iceberg

- Scaled Orders

- Webhook Signal Trading

Opening and Closing a Position

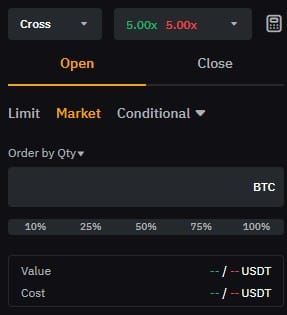

Opening a position on Bybit is extremely easy, and you have multiple ways to do it, depending on the order type that you want to use. For the sake of this guide, we will use a simple market order for demonstration purposes. As you can see in the image below, we have set our leverage to be 5x and we are using Cross margin mode.

To specify the quantity of the order, we’ve simply hit the “50%” button, which takes half of our equity into the position. Below that, you can see that the cost of our position is $14, but the actual value is $71. That’s because of the 5x leverage. Depending on whether we want a long or short BTC position, we can choose between the two options. In our case, we want to long it so that we will press “Open Long.”

Once you hit any of the two buttons, you will see a confirmation window with a summary of your position. Review that and confirm.

After you’ve done so, you will see your position appear in a designated space where you can monitor its performance. It’s right below the center section of the interface.

Here, you can check important performance metrics such as your entry and current price, the liquidation price, your unrealized profit or loss, and so forth. You can also choose to add take profit or stop loss levels (TP/SL), and close your position by choosing one of three methods – Revers, Limit, and Market. These correspond to the order types that we’ve described above.

Bybit Security Review: Is Bybit Safe?

Although using a centralized exchange (like Bybit, Binance, Coinbase, etc) always carries counterparty risks, Bybit is considered to be a safe cryptocurrency exchange.

In terms of security, Bybit employs the so-called “360 platform security.” In simple words, the exchange takes the necessary measures to ensure the security of its users on all fronts. These include:

Asset Protection and Platform Security

Bybit stores user funds offline in cold wallets. To make sure that these wallets are protected from unauthorized access, they employ advanced multi-signature, Threshold Signature Schemes (TSS), and Trusted Execution Environment (TEE).

Privacy Protection

Users can find the extent of the data collected by Bybit in their terms, as well as the way the exchange uses it. In addition, Bybit integrates a privacy-first policy, which spans across all of its products and services.

Advanced Data Protection

Bybit encrypts user data both in transit and in storage. To do so, the platform uses desensitized query interfaces. All access to user data is subject to strict authorization controls. This is designed to guarantee that only users have access to their personal and private information.

Real-Time Monitoring

According to its user-protection page, Bybit also monitors and analyzes user behavior in real time. This means that as soon as there’s some sort of suspicious activity, the team can strengthen the authentication measures for withdrawals and other critical actions on the exchange.

All of the above have ensured that Bybit remains a safe and secure platform for trading. The exchange has never been hacked or exploited.

In addition, following the FTX fiasco back in 2022, Bybit, alongside a range of other exchanges, launched Merkle Tree-verified proof of reserves (PoR). This is available for both trading and funding accounts and adds another layer of transparency. This can also be monitored in real time.

Bybit Support

Our Bybit review continues with one of the most pressing matters – customer support. It is incredibly important, especially when it comes to high-volume trading.

Bybit excels in this regard. In fact, the exchange sets up private groups between its team members and high-volume traders to ensure their optimal experience.

As for regular users, Bybit provides quick and actionable customer support through a number of means. The exchange has a live chat, which we have tested. The queue lasts no longer than a few minutes, which is well beyond industry standards.

Conclusion

Bybit has emerged as one of the largest spot and derivatives cryptocurrency exchanges in the last few years. It boasts a large user base and a large variety of trading tools that are suited for both beginners and advanced traders. Yet, a lot of its products are aimed at people with more experience – this is something to keep in mind.

The exchange is quick to add new trading pairs, catering to those who want to capitalize on both emerging and established crypto trends.

Trending

Tether blends cryptocurrency technology with the stability of traditional money.

BC Game is a massive crypto casino in the online gambling space.

Bitcoin, the world’s first decentralized cryptocurrency..

About me

Hi there 👋 My name is Jane Doe, and this is my blog. Some of my favorite things are cryptocurrency, fun and sun :)